You might think your credit report accurately represents your hard work, your choices, and your financial history. Then a lender pulls your file, and the numbers look nothing like your life. A mystery auto loan surfaces, an address from a state you have never visited shows up, or a maxed-out credit card appears out of nowhere.

These moments leave people stunned, often with no clear sign of what went wrong. Instead, they’re left grappling with a question many consumers eventually face: how often do mixed credit file problems occur?

At Sherman & Ticchio PLLC, we talk with people who walk into this situation with zero warning. One day, they feel ready to apply for a home loan or new job; the next day, they are trying to explain why their report includes someone else’s debts.

Mixed credit problems feel surreal at first because the idea that your file could merge with another person’s seems far-fetched, yet this mix-up occurs far more often than most people realize. It helps to understand why these problems keep happening and how they manage to slip through systems that should protect your identity.

How Often Do Mixed Credit File Problems Happen?

Mixed credit problems happen regularly because the credit bureaus rely on matching systems that do not always separate similar identities. These systems sort massive amounts of data every day, and the slightest overlap can make the algorithm treat two different people as the same person. When that happens, your credit report catches someone else’s financial footprint.

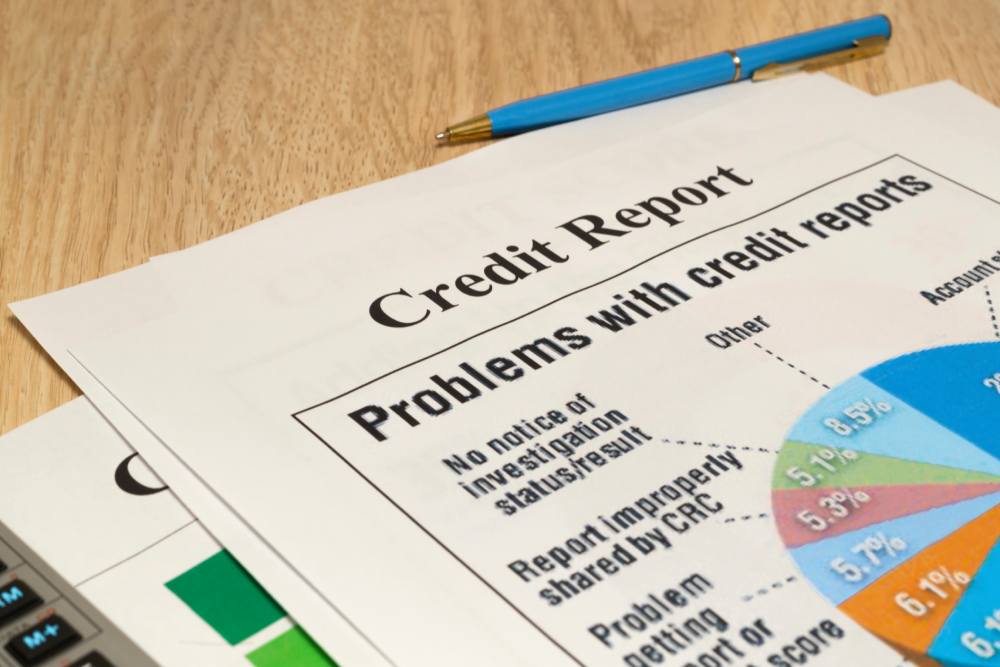

Industry studies have shown that credit report errors remain widespread, and mixed files make up a noticeable share of those issues. While the exact rate varies by source, consumer groups estimate that millions of people each year encounter serious credit report errors. Many never learn about it until a loan application or background screening raises a red flag.

You can explore real-world examples of these disputes on our site’s credit report litigation page, where mixed data appears again and again as a source of serious problems.

Credit reports influence many major decisions. When someone else’s accounts land on yours, it becomes more than an inconvenience. It affects your:

- Ability to secure a mortgage

- Chance of being approved for an apartment

- Loan interest rates

- Credit card approvals

- Background checks for job applications

The ripple effect grows quickly because mixed files often go unnoticed until a major event forces the issue into the spotlight.

Why Mixed Credit Files Form so Often

The credit bureaus depend on automated systems that gather data from thousands of sources. These systems try to match each piece of information to the right person, yet the process does not always catch subtle mistakes. That creates openings for mixed credit issues.

Data Matching that Leaves Too Much Room for Error

Automated data matching leans heavily on a few identifying points, such as name, Social Security number, and addresses. When two people share similarities, the system may link the information even when the rest of the details do not connect to your identity.

Common causes include:

- Similar names across relatives or unrelated consumers

- Shared or past addresses

- Social Security numbers that differ by only one or two digits

- Outdated identifying information

- Human error during data entry

Once the incorrect information enters the system, it tends to replicate across multiple bureaus. This means the same error might appear in reports from Equifax, Experian, and TransUnion, multiplying the impact.

Outdated Records that Won’t Let Go

Old records often linger in credit databases. When the system tries to match new data to outdated identifiers, the chance of a mix-up rises. A former address or incomplete data point might trigger a false match, allowing another person’s account to settle into your file.

Human Oversight that Misses the Problem

When data confusion reaches a point where human review is needed, the process tends to be quick and surface-level. These reviews do not always catch the problem, and mixed files move forward as if nothing happened. That leaves consumers carrying the weight of someone else’s financial mistakes.

Warning Signs that Your Credit File Might Be Mixed

Mixed files often create patterns that stand out once you know what to look for. Many people first notice the problem after a sudden drop in their credit score or a confusing lender denial. Others run into issues when verifying their identity during a background check.

If you see any of the signs below, the odds increase that your report includes another person’s information:

- Unexpected Accounts or Debts

A random credit card or surprise auto loan is one of the clearest signs that your report absorbed someone else’s data. These accounts might show unfamiliar payment histories or past due amounts that have no connection to you.

- Incorrect Addresses or Personal Details

A report showing an address from a place you have never lived creates a strong clue that the system matched your file based on outdated or incomplete information.

- Hard Inquiries You Did Not Authorize

When lenders run your credit without your knowledge, it often hints that someone else applied for credit and your report became part of their application.

- Trouble Accessing Your Own Report

Identity verification questions may not match your life, which makes it hard to access your file. These questions might reference loans or mortgages you have never taken, pointing to mixed data behind the scenes.

This can become especially stressful for people applying for jobs. Background screenings can pull from the same data sources that create mixed credit issues. You can learn more about these situations via our background check litigation.

How Mixed Credit Problems Affect Your Daily Life

Mixed credit issues reach beyond the numbers in a report. They often interrupt significant plans, drain your time, and cause financial setbacks you never saw coming.

Major Consequences Include:

- Denied home, auto, or personal loan applications

- Higher interest rates that raise borrowing costs

- Housing rejections during rental screenings

- Unexplained credit score drops

- Financial stress due to accounts that appear delinquent

- Delays in job opportunities that require background checks

People often do everything right with their financial habits, yet mixed data still places them at a disadvantage. A single inaccurate entry can throw off your report for months. Once incorrect accounts settle into your file, the credit bureaus do not always remove them easily.

Your Rights Under the FCRA

The Fair Credit Reporting Act gives you the right to dispute inaccurate reporting. When your file contains mixed information, you can dispute the errors with the credit bureaus. They must review your dispute and respond within a set timeframe.

Your FCRA rights include the ability to:

- Request full credit reports from all major bureaus

- Dispute inaccurate information

- Provide supporting documentation

- Seek legal support when the bureaus fail to correct the problem

You may be entitled to compensation when the bureaus allow incorrect data to remain on your report or when the mix-up causes financial harm. Many people come to us after trying to fix the problem themselves, only to face incomplete responses or repeated errors.

How to Approach a Mixed Credit Problem

If you suspect a mixed file, gathering information becomes the first step toward fixing the issue.

- Pull all three reports from Equifax, Experian, and TransUnion.

- Mark incorrect entries such as unfamiliar accounts, addresses, and inquiries.

- Submit written disputes to each bureau because written communication lets you keep records and include documents.

- Track all responses so you can see whether the bureaus corrected the issue or left mixed data in place.

- Consider legal support when the bureaus dismiss your dispute or repeat the mistake.

People often discover that the dispute process feels more complicated than expected, especially when multiple bureaus report the same errors. You deserve reporting that reflects your life, not another person’s financial choices.

Taking Back Control of Your Credit Starts Here

Mixed credit issues can disrupt your financial plans and create stress that lingers long after you first notice the problem. Our team at Sherman & Ticchio PLLC works with consumers who deal with these frustrations, and we can review your situation with you so you understand your next steps under the FCRA. You do not have to sort through this alone.

If you discovered someone else’s information on your report, or if a lender raised questions that do not reflect your financial life, reach out to us. Begin taking steps toward restoring the accuracy of your reports today.